School Appropriation Program

The School Appropriation is used when the school tax is received from the Railroad and Utility Billing.

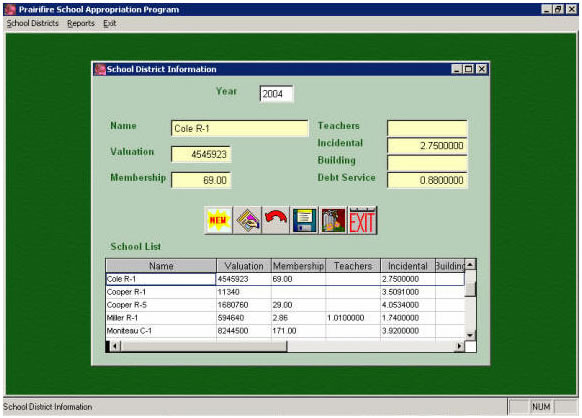

Set up for School Appropriation is very simple. The information is received from the School Districts and is entered into the program.

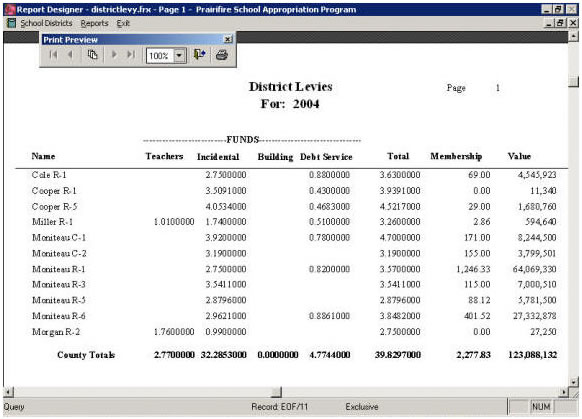

The information includes the School District’s Assessed Valuation, Number of Students, and the tax levies for each of their funds.

Each School District is set up, even if they have no students from your county.

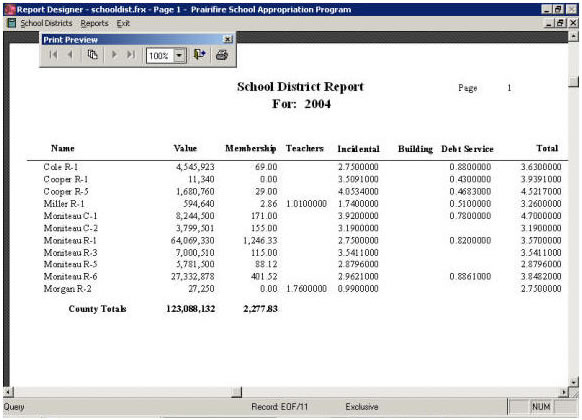

The School District Report is run to verify that all information is correct.

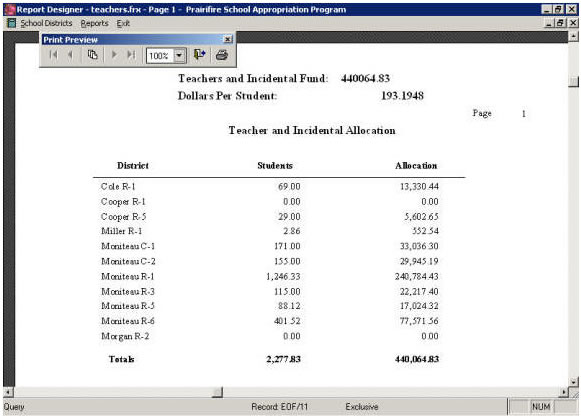

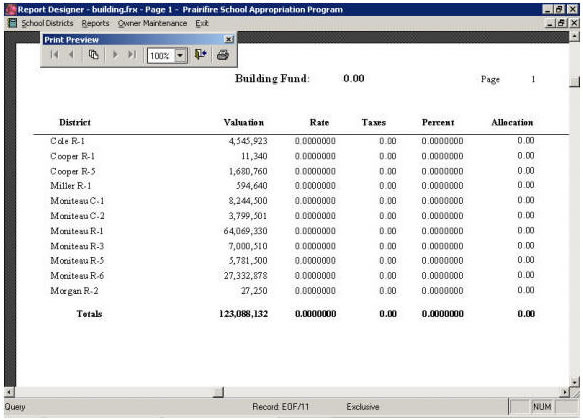

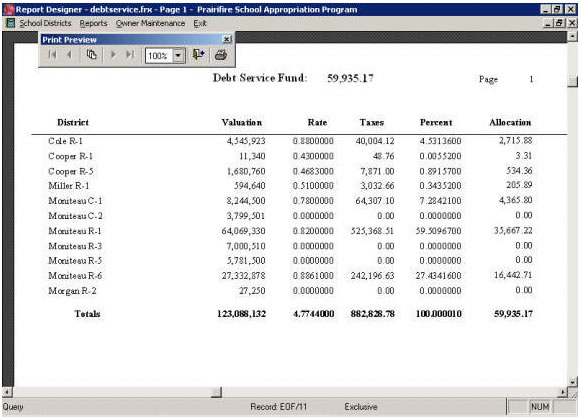

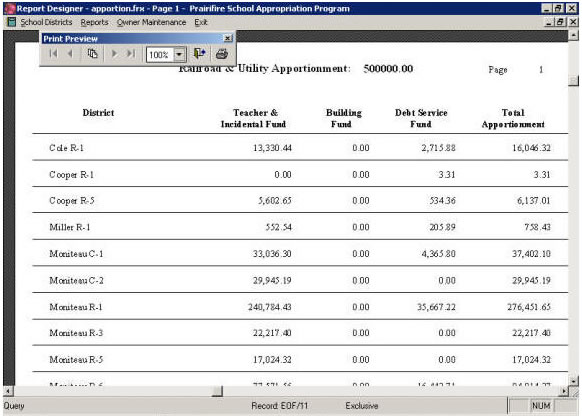

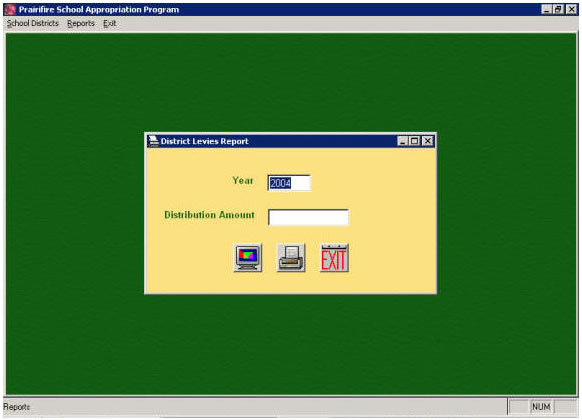

The amount of taxes received is entered.

The Distribution reports are printed automatically.