General Ledger

PSS Governmental Fund Management Software provides up to five breakdowns for general ledger account numbers with the only requirements being fund and object. Transactions can be made between funds, or not, depending on the policies of the government. General Ledger transaction entry will not allow unbalanced transactions and will prevent general ledger entries between funds if the government does not allow transactions between funds.

Reports include a Balance Sheet and Operating Statements. Operating Statements can be printed for revenue only, expenses only or a combination of the two. The Extended Operating Statement has a current period, current Y-T-D, same period last year, last year Y-T-D, budget, remaining budget and remaining budget percentage.

Transactions can be made between funds, or not, depending on the policies of the government. Enter receipts through a separate screen. List items and verify totals before posting to the General Ledger.

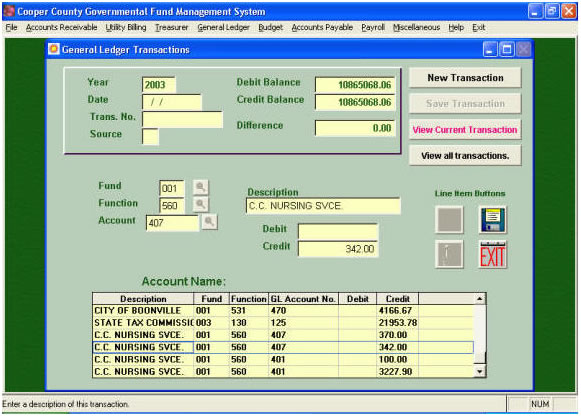

Enter general ledger transactions in the following screen. Enter the account number if known, or use the button next to the fund, function or account number to choose the account number from the list. Transactions should be in balance. If an unbalanced transaction must be made, a password displays to allow you to exit from the screen and accept the transaction.

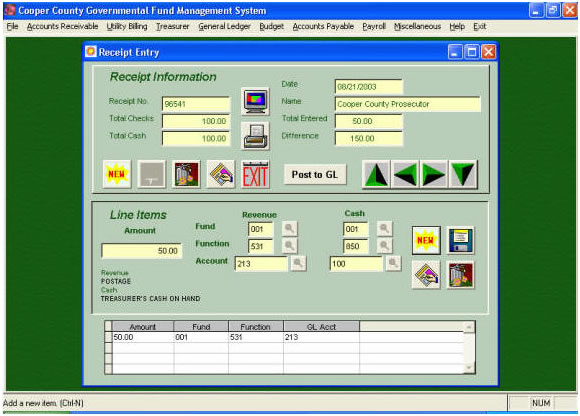

The next screen is the Receipt Entry screen. Enter the total checks and total cash for a transaction. Enter the distribution of the money to the revenue and cash accounts below. When the fund is entered for the revenue account, the cash account defaults to the cash account for that fund. This may be changed during entry. The names of the accounts are displayed under the amount.

Balance Sheet - Prints the assets, liability, and equity accounts and their balances.

Operating Statement - Two of the most common formats are, an Extended Operating Statement that shows the current period and current year-to-date totals, same period last year and last year year-to-date, budget and remaining budget balance, and percent of budget balance remaining and a format that has current period and current year-to-date balances only.

Other formats include:

Summary Operating Statement - Shows totals by fund and department

Operating Statement by Department - Allows the operator to choose a fund and department and only print the activity for that department. This would be helpful for budgeting purposes and for each department head to keep track of their actual income and expenses versus the budget.

Operating Statement with Detail and Operating Statement with Detail by Department - These two reports show the operating statement totals along with all the detail that makes up those totals between the dates chosen. The Detail by Department includes a further choice of printing by department.

General Ledger Activity Report may be printed in summary or detail format. The summary format shows the total debits and credits by date. The detail format shows each transaction in the accounts. The transactions are displayed on the screen and can then be printed to the printer or to the screen in a report format.

Trial Balance is a listing of all chosen accounts with their balances with the total debits and credits at the bottom.

Audit Trial Balance - same as the Trial Balance with additional columns to write in balance changes.

Chart of Accounts - Lists the General Ledger chart of accounts to the screen or to the printer.

GL Transaction Reports - There are four reports under this menu item. These reports are grouped by source, GL-General Ledger transactions, PY-Payroll Transactions, AP-Accounts Payable transactions, RC-Receipt Transactions. Choose the source for which you wish to print the transactions and the date range. Only transactions marked from that source will print on the report.