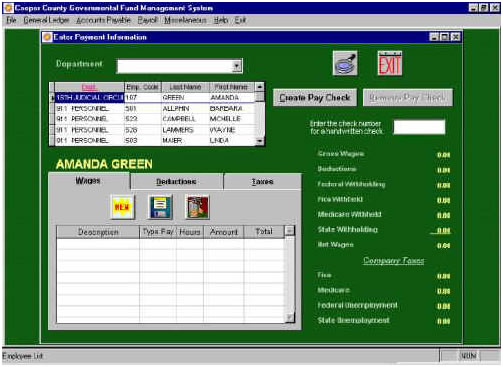

Payroll

Enter payroll information alphabetically by department, employee code, last name or first name for your city and county government. State unemployment, 941, W2's and many other reports are available. There are three cerf reports available at this time that conform to the State of Missouri's standards. When voiding paychecks, all appropriate general ledger entries are made as well as adjustments to totals for the employee.

For cities, job costing is available. Job costing allows the clerk to split out someone's check into jobs in different departments and funds.

Keep track of and accumulate sick, vacation and comp time. Sick and Vacation time can be accumulated every pay period or on demand. Overtime can be accumulated as comp time.

There are many reports available, they are mentioned below with a brief description.

Employee Inquiry - Displays al the checks for each employee separated out by year. The information on one check can be printed or the information for a total year can be printed.

Payroll List - Lists all the active employees with their wage rates. This is to be used to put in hours for a particular pay period.

Wage Summary by Employee/Type - Lists the total for various types of wages, such as regular, vacation, sick, overtime etc. for the time period chosen for this report.

Payroll Employee Detail - Displays all the information entered about this employee, address information, salary, deduction, expense, sick, vacation, tax rates etc.

Employee Pay and Deductions - Displays all the pay and deduction information and rates for an employee.

Y-T-D Payroll Audit Journal - Displays totals by employee for the year-to-date. Also prints totals by department and fund.

Payroll Summary by Department - Displays the totals of the payroll wages, deductions and taxes between the chosen dates and by department.

Payroll Summary by Fund - Displays the totals of the payroll wages, deductions and taxes between the chosen dates and by fund.

Payroll Summary by Grand Totals - Displays the payroll wages, deductions and taxes for the whole governmental body with columns showing which items are federal, fica, medicare, and state pre-tax.

Check Register - Lists the checks written with the employee code, name, check date, period ending date, amount and a space to write in the cancel date.

Payroll Item Report - Lists the employee code, name, the current, month-to-date, quarter-to-date, and year-to-date figures by wage type, deduction type or tax type.

Payroll Item Report Between Dates - Lists the same information as the report above except that the information can be chosen between two dates instead just one payroll period.

Payroll Hire/Terminate Report - Lists the employees hired or terminated between the two dates entered.

Sick/Vacation Report - Lists the employees chosen with their pay types, the hours used and the hours available. This report includes any type of pay chosen, such as regular, vacation, sick, holiday etc. There are four different views of this report, summary, detail, one page per employee and the current status.

Payroll Wages Report - Lists all the employees with gross, net, federal, fica, medicare and state wages. The second of this reports shows federal, fica, medicare and state taxes. The report is totaled by department and by fund.

Employee Anniversary Report - Lists the employees, their department, the date hired and the number of years employed.

Employees with Automatic Deposit - Lists all employees with automatic deposit and all the information regarding where their payroll checks are going, the bank, the amount going to that bank and the bank account information. This list is used as a check to make sure all information is entered correctly.

Gender Report - Lists the number of male and female employees in summary and in detail.

State Unemployment Report - Prints the information for the state unemployment report.

State Unemployment Worksite Report - Lists the employees with the quarter, month and gross pay by worksite. It includes a summary with the number of employees and wages by work site for each month in the quarter.

Workman's Comp Reports - Lists the type of pay, hours and gross pay by department and fund or by workman's comp code. It also lists the number of full and part time employee.

940 Report - Prints the quarterly 940 report.

941 Report - Prints the quarterly 941 report.

W-2 Forms - Prints the W-2 forms. W2s can be sent electronically. W2s can now be printed on plain paper.

Form 1095-C Report - Prints the information on the Form 1095-C required by the Affordable Care Act.

Cerf Report - Reports the 2% deductions, eligible non-contributions, forfeited, opted out, and what was refunded.

Lagers Report - Lists the lager's number, employee name, gross wages and lager's contribution.