Railroad & Utility Billing Program

County Clerks are all aware of the tedious and time-consuming task of billing Railroad and Utility Companies in their counties. The State of Missouri appraises these companies and notifies the County Clerk in each county of the assessed values within all their tax districts. The tax income to the counties is a substantial portion of the county’s revenue budget. Therefore, Railroad and Utility billing is an important part of the County Clerk’s duties.

Prairifire Software Solutions has made this task a simple matter. Two programs are included in the entire package. One is the Railroad and Utility Billing and the other is the School District Appropriation to distribute the money to the School Districts when it is received.

Following are some screen shots of the software and descriptions of how the programs work.

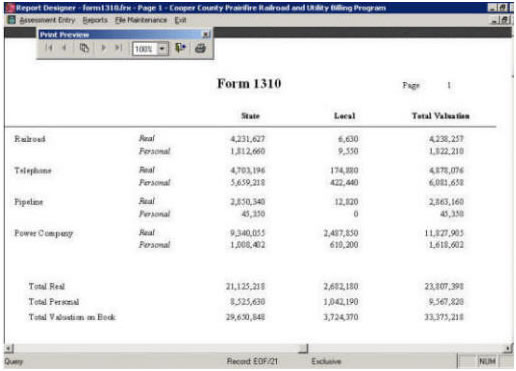

Company Types are set up according to the type of companies doing business in the county and how the County wishes to distribute the totals on form 1310.

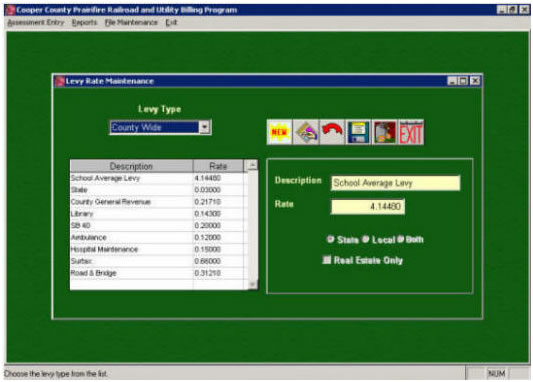

Levy types are set up according to the taxing districts within the County. For example, if the county has only one road district, it would be put under County Wide because everyone in the county pays taxes for it.

Schools are put in the County Wide levy type because everyone pays taxes for schools. However, the school rate is an average based upon the School District Levies of all the School Districts within the County.

Levy rates are then set up. This is the tax rate per $100 valuation and is entered as a dollar amount.

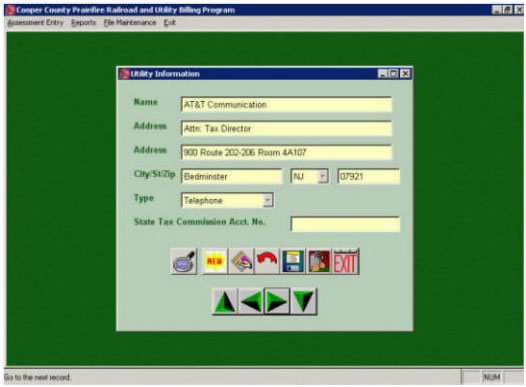

Company information is entered for each company. This information includes billing address and type of company.

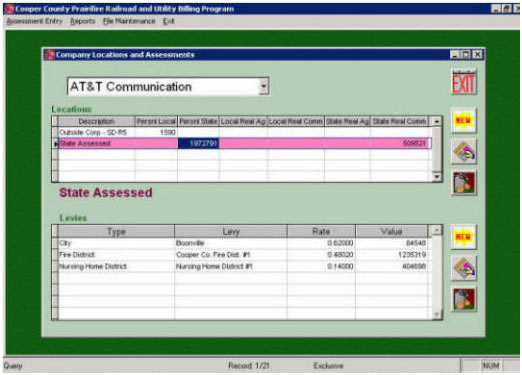

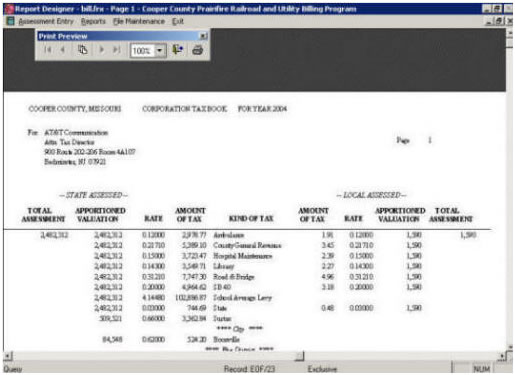

The State Assessed information is entered as well as Locally Assessed information that is received from the County Assessor.

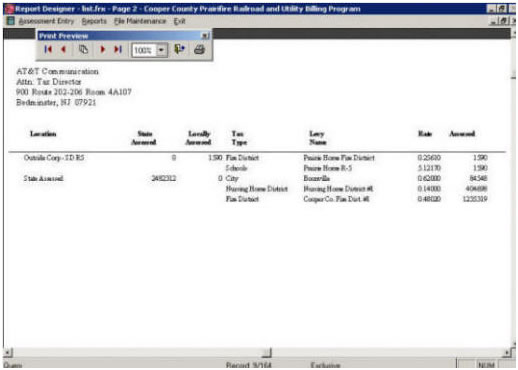

The Assessment List is printed so the information can be checked for accuracy prior to printing the Tax Bills.

After all information is checked and corrected, the Tax Bills are printed. Bills are printed with State Assessed values on the Left and Locally Assessed values on the Right with a summary and total due at the bottom.

Form 1310 information is printed after bills are printed and checked for accuracy.